A couple weeks ago I participated in the RBC RESP Twitter Party. Have you ever participated in a Twitter Party yourself?

They can be fast paced, but they are very easy to join. There is a hashtag that you can follow along with where you can see questions asked and answered by experts, and participating can often lead to giveaways and prizes. They are pretty fun, and a lot of your questions can be easily answered!

If you are ever shy about asking questions, or in some cases don’t know who to ask, a Twitter party is a great way to learn more about something from experts in that field.

In this case, I had all of my RESP questions answered by RBC. Some of the most frequent, and most insightful questions were ones that I hadn’t even thought of!

For example, when the RESP is withdrawn, who pays the taxes?

If the student is enrolled in post secondary education, they pay the tax. I had no idea!

One of my biggest questions was what happens to an RESP if a child decides not to pursue postsecondary education?

The plan can remain open for 36 years. Upon cancellation, you could transfer money to a sibling or rollover to your own RRSP. I had always wondered what would happen if my son decided not to attend postsecondary schooling! If your child decides not to go to university, the original contribution can be withdrawn and wouldn’t be taxed, and earnings in the plan could go over to your RRSP; grants money must be repaid.

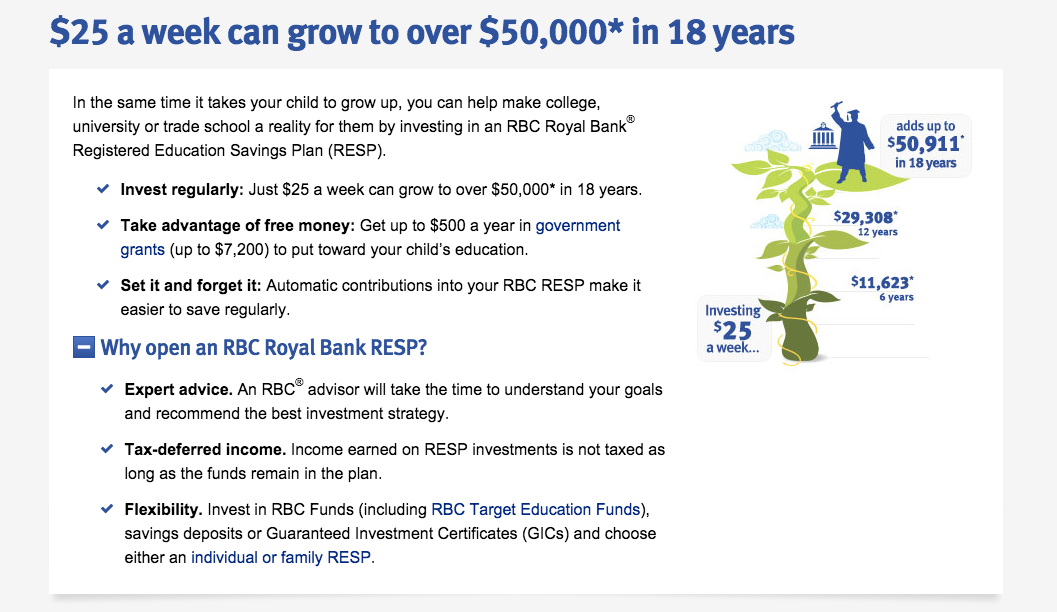

If you missed the Twitter party, and your questions were not answered in my re-cap, then you can ask questions and learn more about RESPs from your local RBC branch, or visit them at http://www.rbcroyalbank.com/save-regularly/resp.html!

Right now RBC is running a great contest called Grow your RESP with RBC Contest!

Your have a chance to win 1 of 4 prizes of $500 to put towards your won RESP. The contest ends October 4, 2015. Enter here!

To learn more visit: http://www.rbcroyalbank.com/save-regularly/resp.html.